South Korea and Morocco Join Forces on $13.5 Million Green Industry Initiative

Pioneering the Atlantic: Morocco’s Strategic Roadmap for Offshore Wind

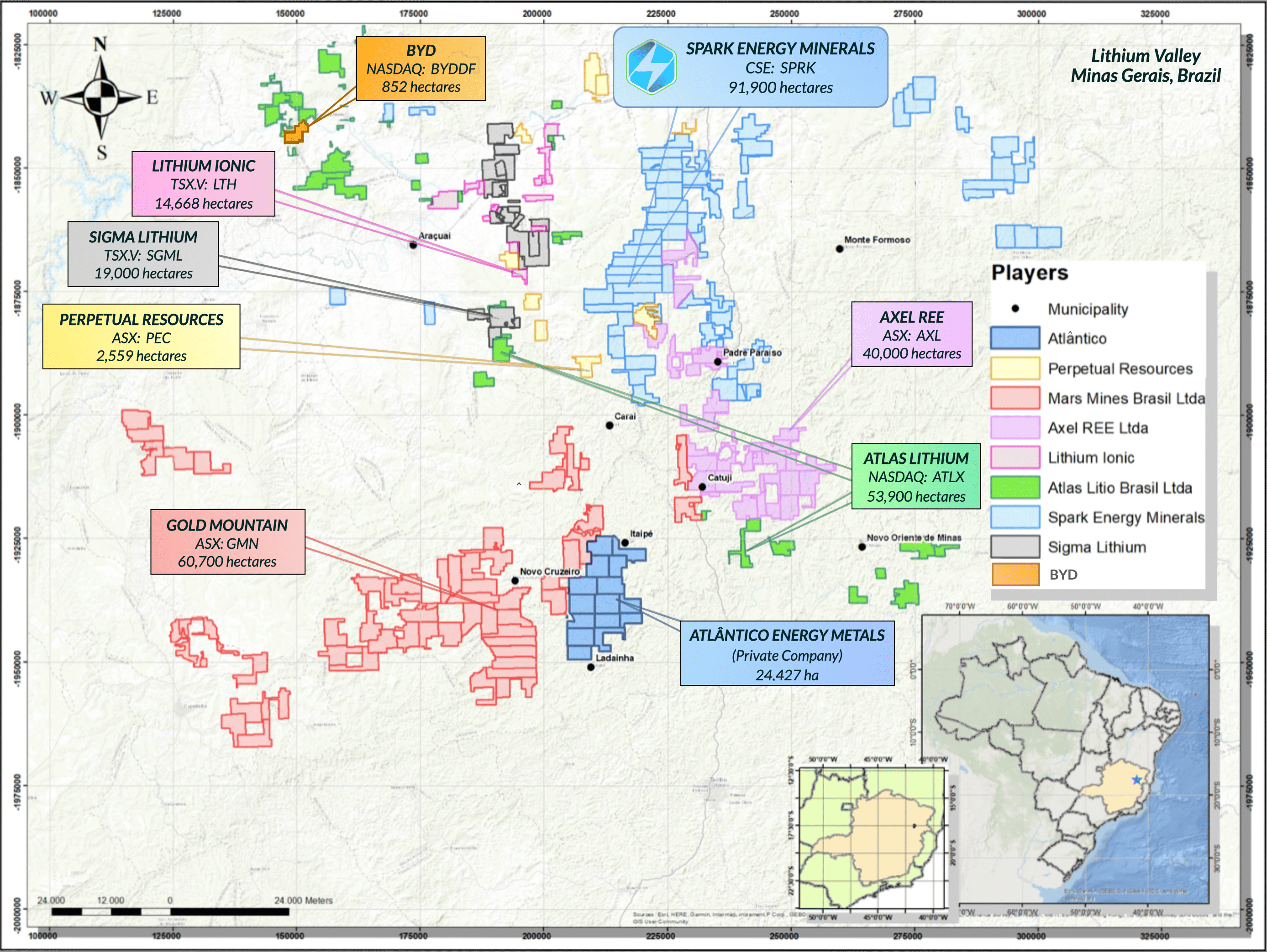

Since its launch in 2022, Brazil’s “Lithium Valley” has already attracted more than US $1.18 billion in announced investments, drawing major players into the Jequitinhonha region of Minas Gerais. At the center of this surge is Spark Energy Minerals, which controls nearly 92,000 hectares — the largest contiguous landholding in the Valley — with a dual focus on rare earth elements (REEs) and lithium, two commodities critical to the clean energy transition.

This article draws on insights from Spark’s August 2025 presentation to examine the company’s strategy, assets, and potential role in shaping Brazil’s critical minerals landscape.

Link to Spark’s Q3 Corporate Presentation: https://drive.google.com/file/d/1CekntQhTZ0nouPiWYWsGQlHQc7HwGDwx/view?usp=sharing

Spark controls ~91,900ha in Lithium Valley, including a ~64,000-ha contiguous block — the largest contiguous position in the district. This positions Spark adjacent to some of the region’s most significant emerging discoveries — including Axel REE’s ionic adsorption clay (IAC)–style, clay-hosted rare earth system, described by the company as hosting high-grade REE mineralisation — as well as BYD, which is understood to hold exploration claims in Brazil’s Jequitinhonha Valley through a local subsidiary.

The company’s footprint is significant: its landholding not only dwarfs most peers but also sits along known mineralized structures. This provides Spark with direct exposure to the same geological systems underpinning billion-dollar valuations at Sigma Lithium and Lithium Ionic.

The image below highlights Spark Energy Minerals’ dominant landholding in Brazil’s Lithium Valley, showcasing its rare earth, gallium, and lithium discovery potential.

Spark’s most immediate focus lies on the Caladão Trend, where its concessions directly border Axel REE’s discovery. Early exploration has revealed highly encouraging signs:

These results align with the unique potential of Brazil’s ionic adsorption clay (IAC) deposits — one of the few systems outside China known for high recovery rates and low-cost extraction. For gallium in particular, Spark’s assays suggest strategic importance, given gallium’s role in semiconductors and its restricted supply chains.

While rare earths may capture headlines, Spark is also advancing a strong lithium portfolio. At its Cruzeta Project, mapping and sampling have confirmed pegmatites consistent with spodumene-hosted systems, with assays up to 3,712 ppm Li. Four lithium drill targets have been identified, located within the same structural corridor as Sigma and Lithium Ionic’s world-class deposits.

This positions Spark to benefit directly from growing demand for cost-efficient lithium production. Brazil’s lithium projects, already producing at nearly 50% lower costs than Australia, are rapidly gaining attention from automakers and battery manufacturers seeking diversified, ESG-compliant supply.

Spark’s projects sit in Minas Gerais, one of Brazil’s most mining-friendly states. The region boasts extensive infrastructure, including highways, rail connections, ports, and abundant renewable hydropower. Since Brazil lifted its lithium export restrictions in 2022, the sector has attracted a wave of foreign investment, with state and federal governments actively promoting critical minerals development.

This policy and infrastructure foundation gives Spark a platform to advance projects with fewer logistical and regulatory barriers compared to many other frontier jurisdictions.

Spark is advancing its Phase 1 exploration program with a focus on progressing priority targets toward drilling while continuing complementary phases of exploration. Current and planned activities include:

These efforts are designed to leverage Spark’s dominant land position across the emerging eastern extension of Brazil’s Lithium Valley, with the goal of generating near-term catalysts and positioning the company to confirm discovery-scale systems by late 2025.

Spark’s leadership is another differentiator. The board and advisors include:

This combination of local knowledge and global discovery success strengthens Spark’s ability to deliver results in Brazil’s complex but highly prospective geology.

Spark Energy Minerals exemplifies the new wave of junior explorers driving Brazil’s critical minerals revolution. Its dual focus on rare earths and lithium not only diversifies risk but also positions the company at the nexus of two supply chains essential to clean energy technologies.

For the industry, Spark’s story highlights three broader shifts:

If Spark delivers on its exploration roadmap, it could evolve from an $5M market-cap junior into a meaningful player — or even an acquisition target — in Brazil’s critical minerals sector. For investors, OEMs, and policymakers, Spark Energy Minerals is one to watch closely as Brazil cements its role in the global energy transition.

For corrections, updates, or to share additional insights on this topic, please contact:

Alberto Cruz

Marketing Director, IN-VR

E: alberto@in-vr.co